do i have to pay taxes on fanduel winnings|Understanding Fanduel Earnings Taxes: Common FAQs Answered : Cebu A Form W-2G reports gambling winnings and any income tax withheld on those winnings. Reporting and withholding requirements depend on the type of gambling . Tingnan ang higit pa Guía de "Mega Man X" para la consola Super Nintendo Entertainment System/Nintendo Super Famicom, y la edición de "Mega Man X Collection" de Sony Play Station 2, y Nintendo Game Cube. Tú controlas a Mega Man X, un "Cazador de Maverick" de rango "B", cuya misión es erradicar "Mavericks". Tu arma principal es X-Buster, un cañón de .

PH0 · Where can I see my Win/Loss or Player Activity

PH1 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH2 · Taxes on Sports Betting: How They Work, What’s

PH3 · Taxes

PH4 · TVG

PH5 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH6 · Sports Betting Taxes: How They Work, What's Taxable

PH7 · Sports Betting Taxes Guide (How to Pay Taxes on Sports Betting)

PH8 · How to Pay Taxes on Sports Betting Winnings

PH9 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

PH10 · Effective Strategies to Handle Tax Withholding on FanDuel Winnings

PH11 · Effective Strategies to Handle Tax Withholding on FanDuel

Support Newgrounds and get tons of perks for just $2.99! Create a Free Account and then.. Become a Supporter! Rocked Bocchi Share. Curing her anxiety one plap at a time. And apparently, her big breasts are canon, so.. huh. Gobboman. 2022-12-18 17:00:34. The greatest thing is discovering fanon boobies are canon boobies.

do i have to pay taxes on fanduel winnings*******We’re legally required to withhold federal taxes from winning transactions on horse race wagering when both of the following conditions are met: 1. Winnings (reduced by wager) are greater than $5,000.00; and 2. Winnings (reduced by wager) are at least 300 times the amount of the wager Tingnan ang higit pa

The Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional movement such as deposits, withdrawals, winnings, bets, and more. Learn more about the Player Activity Statement . Tingnan ang higit pa

A Form W-2G reports gambling winnings and any income tax withheld on those winnings. Reporting and withholding requirements depend on the type of gambling . Tingnan ang higit pa

FanDuel may be required to report your activity on its Daily Fantasy Sports/Faceoff products to the IRS and applicable state taxing authorities based on the IRS Form 1099 information reporting rules. As it presently stands, FanDuel only reports activity on . Tingnan ang higit paFanDuel will issue a Form W-2G for each sports betting transaction when both of the following conditions are met: 1. Winnings (reduced by wager) are $600.00 or more; and 2. Winnings (reduced by wager) are at least 300 times the amount of the wager Tingnan ang higit pa Do I have to pay FanDuel taxes? First, we’ll state that you must report any winnings to the IRS. FanDuel sportsbook strongly advises you to get an expert to do this .

If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file your sports betting . Fanduel operates under the guidelines of the Internal Revenue Service (IRS). They issue a 1099-Misc tax form for winnings over $600. However, if you win . But whether you're wagering on the World Series from your couch or flying to Las Vegas for a weekend at the tables, you'll have to pay taxes on your winnings. Yes, but you can never write off more than you've won and to do so you must itemize your deductions, unless you bet for a living. So if you won $1,000 at DraftKings but lost $1,500 at FanDuel over all of . Just like your paycheck, FanDuel winnings are subject to tax withholding. Don’t worry though, we’ve got your back. In this article, we’ll guide you through the ins .If you win money betting on sports from sites like DraftKings, FanDuel, or Bovada, it is also taxable income. Those sites should also send both you and the IRS a tax form if your .

DISCLAIMER - We strongly recommend that you consult with a professional tax consultant when preparing your taxes as you may need to report your winnings even if you do not .This statement is not a tax document. You can read much more about taxes and FanDuel by clicking here. There's even more you can see inside the Tax Center: FanDuel Tax Center and Forms. Where can I find my .How Are Group Lottery Wins Taxed in Ohio. Group lottery wins on the individual level are taxed at the same rates as gambling income and individual lottery wins. The process is different however. You fill out Form 5754 and upon receipt, Ohio Lottery will then provide each member of the group with a W-2G form. Taxes on Multi-State Lottery Wins

Understanding Fanduel Earnings Taxes: Common FAQs Answered According to an IRS publication on the subject, if you win more than $5,000, the casino or sportsbook may be required to withhold 28% of your winnings. Illinois has a 4.95% flat state income tax rate, and this is the percentage that would be withheld at the state level. For lottery winnings, they withhold the 4.95% if you win $1,000 or more.

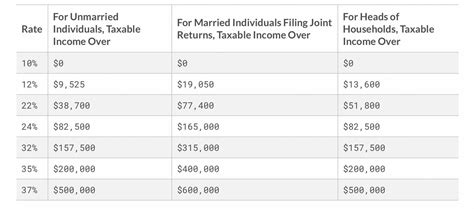

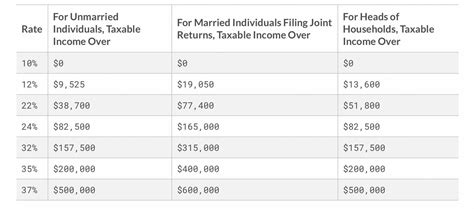

do i have to pay taxes on fanduel winnings No. The tax implications differ considerably between these two categories. For professional gamers, Fanduel winnings are considered regular income. This means they’ll be subject to the same tax rates as any other earnings – ranging from 10% to 37% based on income brackets for 2021.Do I have to pay taxes on my FanDuel winnings? FanDuel is legally prohibited from providing tax advice and unfortunately cannot answer this question. Instead, we highly suggest you reach out to a professional tax advisor with any personal income tax questions. You are solely responsible for recording, reporting, paying, and accounting . No, gambling winning and losses reporting did not change at all with the new tax code. Winnings have always been reportable and taxable and losses, up to the amount of winnings have always been deductible as part of your itemized deductions. If you do not have enough deductions in total to itemize, then you lose the deduction of . Currently, there are no tax deductions for fantasy league winnings. Before 2018, you could write off the entrance fees under miscellaneous deductions. However, the tax laws changed under the Tax Cuts and Jobs Act and eliminated miscellaneous deductions like this one. Learn more: Need-to-Know Tax Reform.Sometimes the Win/Loss statement is called a Player Activity Statement. This is a view of all the gameplay, bets, transactions, and contests you enter with FanDuel. You can find all things financial across all our FanDuel products, including how much you have deposited, played and won. You can also customize and view certain months throughout .

How FanDuel Winnings Are Taxed. When a player makes a bet on FanDuel and earns over $600, the platform reports it to the IRS if the odds are 300 to 1 or greater. FanDuel also sends a W2-G form to both the IRS and the player that they can use when filing taxes later. However, when a player earns over $5,000 on a wager, FanDuel .

There are seven tax brackets as of 2024. You would have to have an individual income above $100,525, including your winnings, to move into the 24% tax bracket. That increases to $201,050 for .

There is a 15% tax rate if you earn $600 or more betting on sports in Illinois. This amount is cumulative over the course of the year. You should receive a Form W-2G from each sportsbook that paid out to you. Again, use the information on those forms to report your sports gambling winnings to the IRS and the state.

For federal taxes, there are two types of withholdings on gambling winnings: a regular gambling withholding (24% or 31.58% for certain non cash payments) and back withholding also at 24%. If your .

Massachusetts taxes ordinary income at 5%. This means there is not a set gambling tax rate in MA. It will be treated differently than your income, but the rate will depend on your overall taxable income. You should keep any documentation you receive from a sportsbook, especially pertaining to a loss.Do I have to pay taxes on my FanDuel winnings? FanDuel is legally prohibited from providing tax advice and unfortunately cannot answer this question. Instead, we highly suggest you reach out to a professional tax advisor with any personal income tax questions. You are solely responsible for recording, reporting, paying, and accounting . Do You Have to Pay Taxes on DraftKings, FanDuel, BetMGM, and Other Fantasy Sports Bets? . How Much Tax Do You Pay on Fantasy Sports Winnings? If you win more than $600 playing fantasy sports, you will likely pay a flat 24% tax. Some fantasy sports sites and apps may even require you to file a W-9, so they can withhold 24% of .Yes. Like most types of income, gambling winnings are taxable at both the federal and state level. Regardless of whether they win $4,999 or $4.99, the law requires people in Massachusetts to document their windfalls and pay a portion to the authorities.

By Kevin Spain. @kevin_spain. February 14, 2024 12:19pm. Fact Checked by Blake Weishaar. Arizona state tax on gambling winnings for individuals ranges from 2.59% to 4.50%, and that's regardless of whether you're sports betting in Arizona, playing at casinos or betting on horses. First Bet Safety Net up to $1,000 in Bonus Bets.While FanDuel winnings are generally considered taxable income, not all winnings may be subject to reporting depending on the amount won and the frequency of your gambling activities. Amount won: As mentioned earlier, the IRS has set a reporting threshold of $600 for gambling winnings. If your total winnings from FanDuel in a tax year exceed . Therefore, after your loss deductions are made, the remaining winnings will be taxed. For example, if a bettor had $10,000 in sports betting winnings in 2021, and $8,000 in losses, he could deduct .

The best computer monitor we've tested is the Acer Nitro XV275K P3biipruzx. It isn't the absolute best at one specific usage, but it's versatile and great for many different usages, making it a jack-of-all-trades monitor. . See our recommendations for the best budget and cheap monitors. See our review. Best Cheap Monitor. Dell .Build your acca for today and upcoming fixtures with our football accumulator tips. Covering games across England, Europe and the rest of the world. . your 5+ fold football accumulator loses by .

do i have to pay taxes on fanduel winnings|Understanding Fanduel Earnings Taxes: Common FAQs Answered